🔑 Core Points

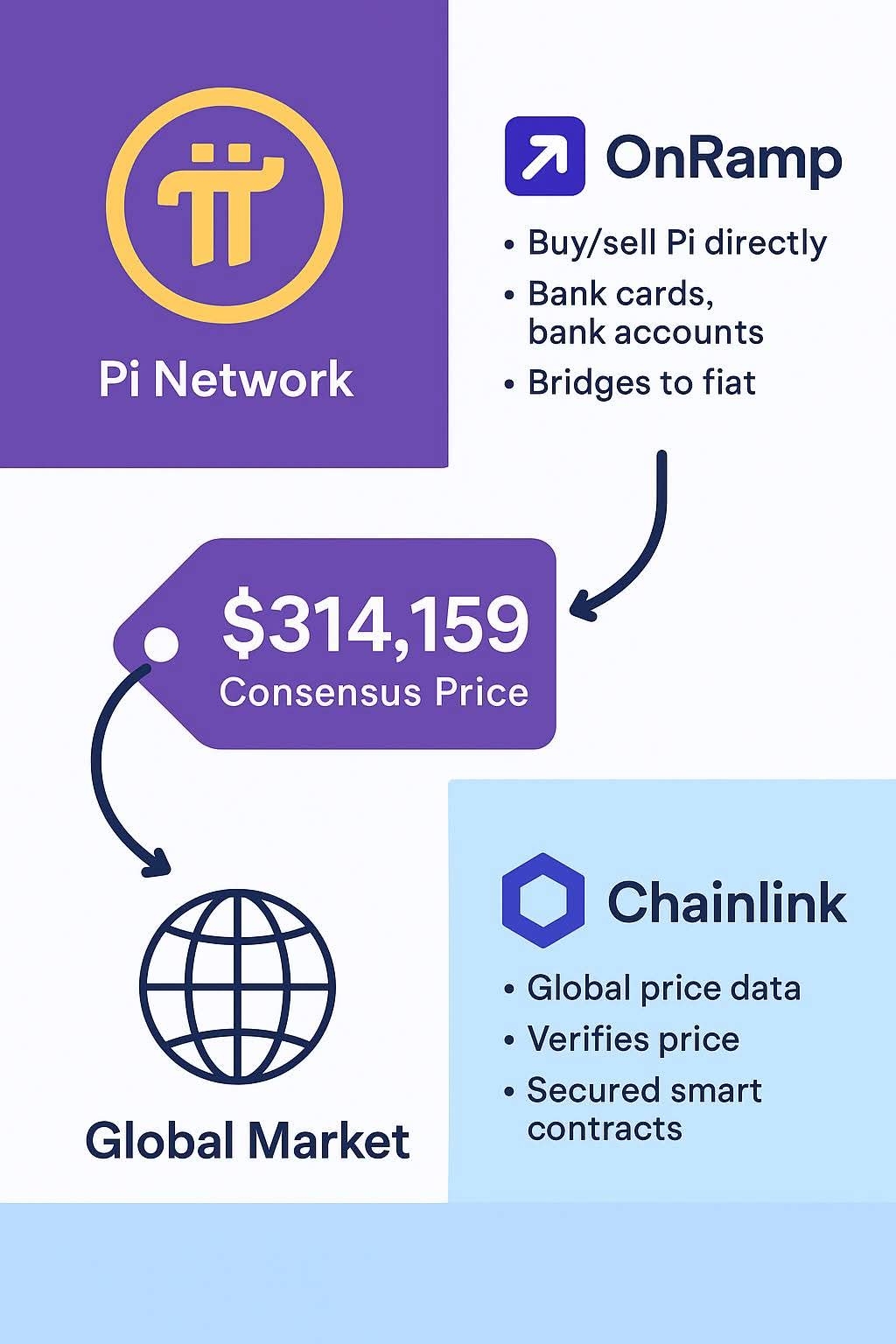

1. OnRamp = Monetary Bridge

Provides buy/sell gateways for Pi using bank cards and bank accounts.

Connects Pi to the global financial system without speculative exchanges.

Every transaction via OnRamp becomes a real-world stress test for Consensus Price.

2. Chainlink = Data Bridge

Brings reliable global price data into Pi smart contracts.

Turns the Consensus Price from an “internal agreement” into a technically verifiable mechanism.

Prevents manipulation or gaps between Pi’s internal economy (P2P) and external fiat markets.

3. Pi Network = Ecosystem

Community and verified businesses (KY generate real demand and supply.

When a merchant sells a car or property in Pi at $314,159, cashes out via OnRamp, and the price is verified by Chainlink, it equals progressive global adoption.

🌍 Strategic Implications

1. Social Value → Economic Value

At first: 314,159 is a “community-agreed” number.

With OnRamp + Chainlink: it becomes a globally redeemable value

2. Internal Adoption → External Recognition

Local merchants accept Pi.

Banks receive funds via OnRamp.

Global markets see transparent price data via Chainlink.

Outcome: institutional trust builds.

3. Symbolic Price → Global Benchmark

If 314,159 holds up under demand pressure, it could act like a peg (similar to stablecoins).

Difference: Pi isn’t speculation-driven; it’s utility-driven.

🌀 The Challenge Ahead

As external demand rises (from investors or exchanges), can the 314,159 consensus price hold?

Or will Pi need a flexible stabilization mechanism (like a price band or staking-based stability)?

Chainlink helps secure price feeds, but ultimately global supply and demand will decide.

✅ Final Takeaway

OnRamp = Converts value into cash

Chainlink = Secures value with data

Pi Network = Generates value through usage