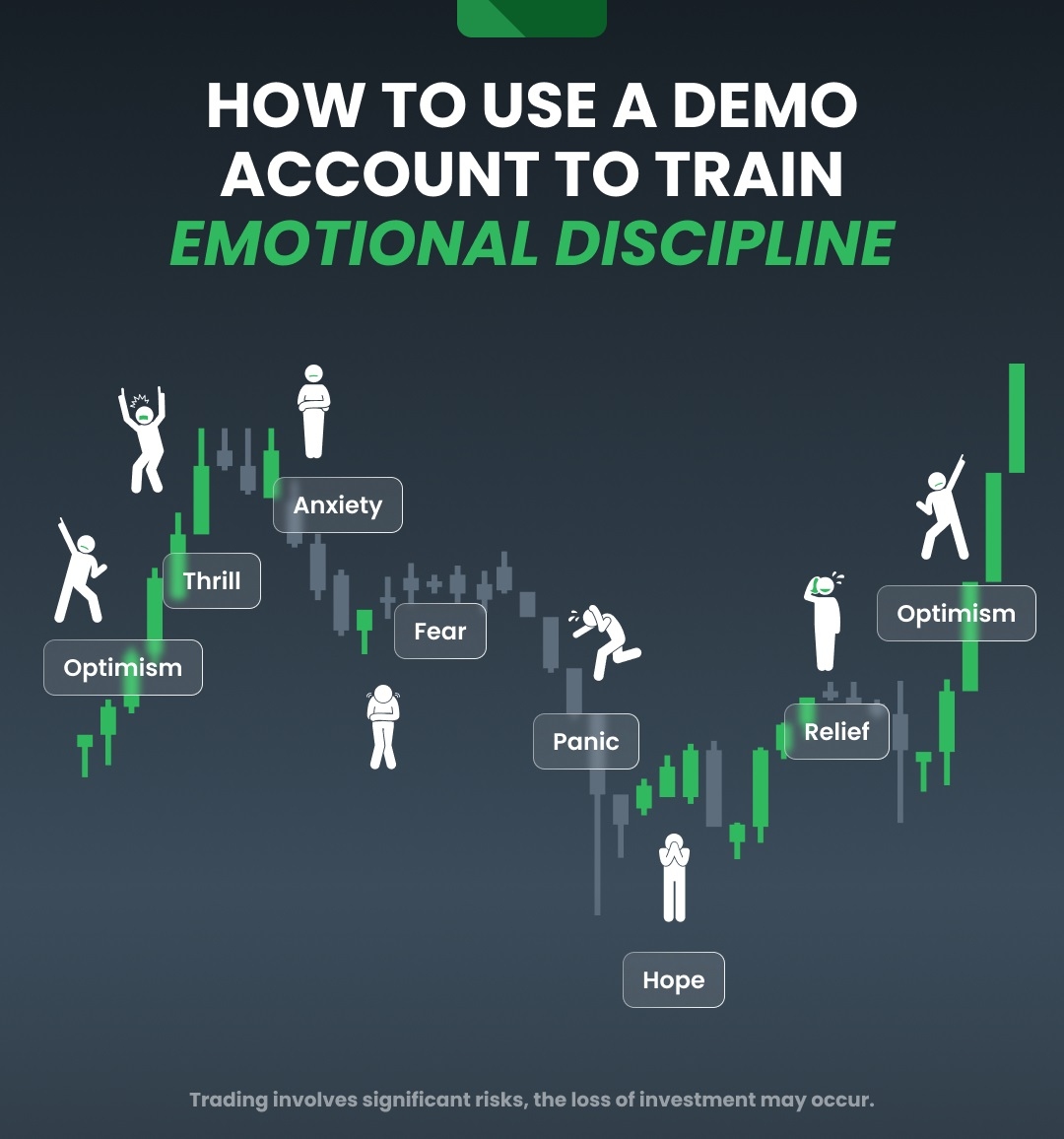

Analytical skills matter. But emotional discipline is also makes you a real trader.

Here’s how to make your demo work for your mindset:

1. Write down your strategy.

Decide entry, stop-loss, and take-profit levels before clicking “Buy” or “Sell.”

If you break your plan, log the mistake in a journal. Seeing the pattern of “plan breakers” will help you resist real-money impulses later.

2. Time your decisions.

Give yourself 30–60 seconds to execute your plan after news releases or big candles form. This recreates the adrenaline rush of live trading without the risk.

3. Journal not just P/L but feelings.

After each demo trade, note how you felt: anxious? Overconfident? Doubtful? Over time, you’ll spot triggers and can build rules to cope with them.

4. Scale position size.

Once you complete 10 demo trades with your rules and keep a positive balance, increase your lot size by 10%. This step-by-step pressure makes you ready for the real trading.

5. Use tools to support your discipline.

Set stop-loss and take-profit. Get price alerts for smarter trading. Automation keeps your emotions out of the execution.

Start training emotional control with demo account, and you’ll be ready to trade live without letting fear or greed decide for you.