While everyone bets against it — the dollar is getting stronger.

Despite bearish bets, the Fed stays firm, inflation ticks up to 2.7% (July 2025, US BLS), and Trump’s tariffs keep adding fuel.

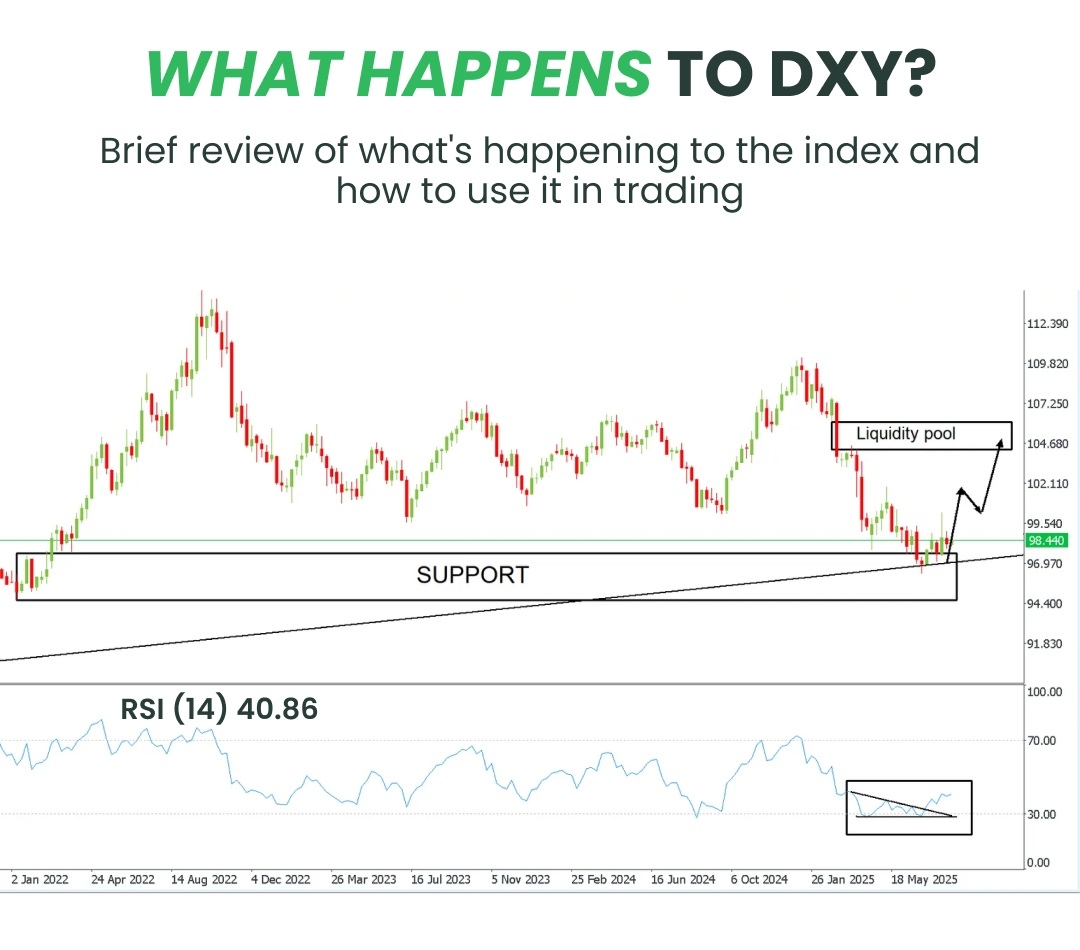

📈 After bouncing from the 96 support and breaking a bearish RSI triangle, DXY is now eyeing the 104–106 liquidity zone — a hotspot for reversals or breakouts.

💡 Why it matters

– EURUSD and GBPUSD tend to fall as the dollar gains strength.

– USD-crosses like USDCAD and USDJPY often rise.

– Risk assets (stocks, emerging markets) may come under pressure.

📊 How to trade it

– Watch the DXY chart to find entry points — it’s your roadmap for USD strength.

– Buy USDCAD, USDJPY, USDCHF on pullbacks while price holds above the rising trendline and sell EURUSD, GBPUSD.

– Use extra tools like RSI, trendlines, or Fibonacci for better timing.

– When USDollar index (DXY) will reach 104–106 level, the dollar may face resistance. — be ready for a pullback or correction

– If price breaks the monthly support trendline, prepare for a potential downward trend.

This isn’t noise — it’s a setup in motion.

Matthew God'spower

Slet kommentar

Er du sikker på, at du vil slette denne kommentar?