지루한

이 게시물은 단조롭고 지나치게 반복적이라는 이유로 사용자들로부터 많은 피드백을 받았습니다.

로딩중..

The anatomy of a trader’s week isn’t looking 100% charts.

Preparation, mindset, and review take the biggest share — execution is just one piece of the puzzle.

Save this chart and let it guide your trading flow.

#forex #forextrader #investor #followers

Not every breakout is a signal to enter. Weak ones often lead to false moves.

This quick guide makes it easy to tell them apart.

✅ A strong breakout shows momentum and is more reliable.

❌ A weak breakout lacks strength and usually reverses.

Learn to tell the difference.

#tradingtips #trendtraders #tradersmindset #forextrader #forexinvestor

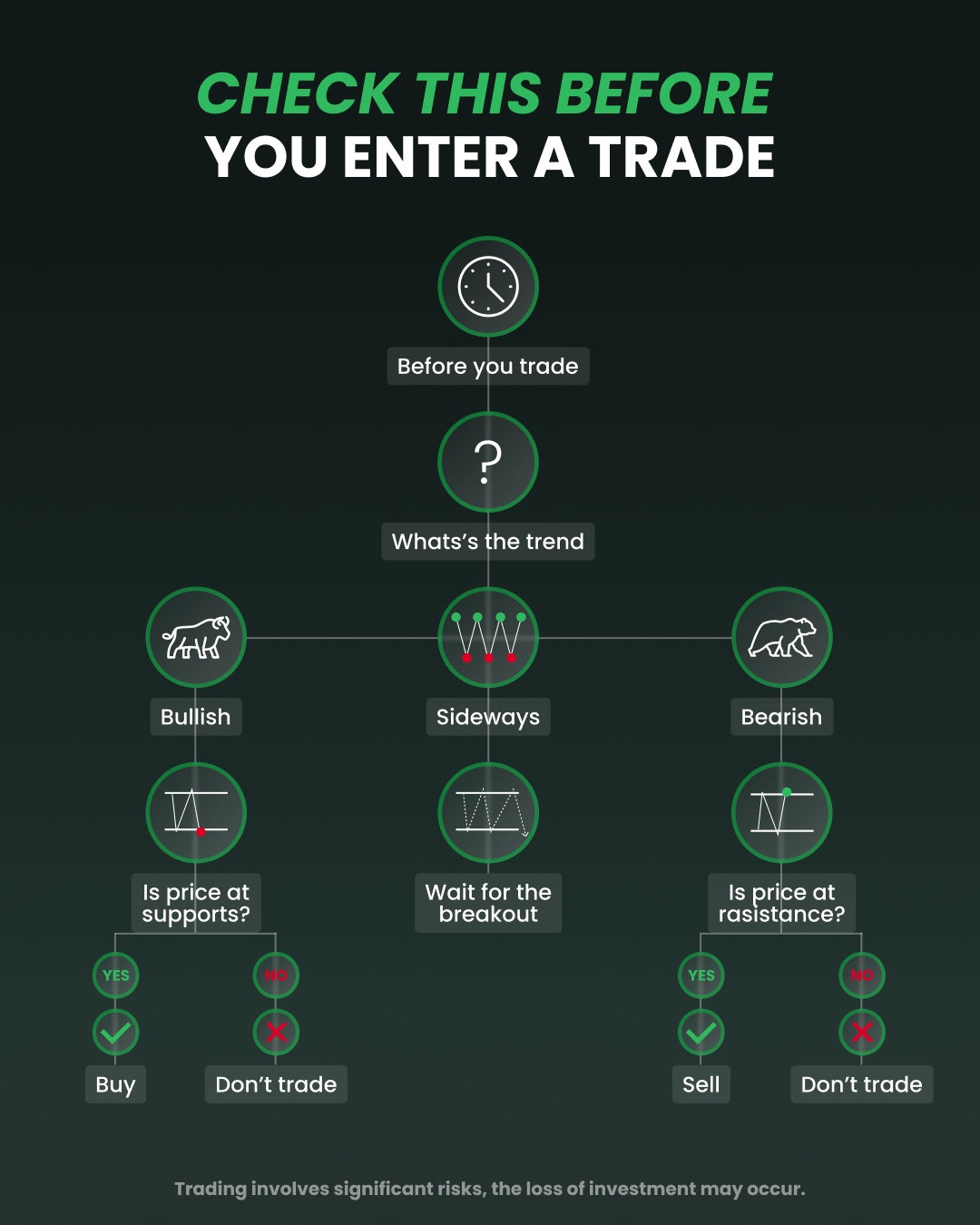

Tired of second-guessing every trade?

This visual checklist helps you make clear, confident decisions in seconds:

✅ Identify the trend: bullish, bearish, or sideways

✅ Check key levels: support or resistance

✅ Act based on the price context

Are you looking for an experienced Forex account manager? Then don't forget to contact me.

I have all my training in trading. So if you can give me Investor Fund, please talk to me.

#tradingtips #forexinvestor #trendtraders #tradersmindset

Sidi boureima Guire

댓글 삭제

이 댓글을 삭제하시겠습니까?

Hamado Sawadogo

댓글 삭제

이 댓글을 삭제하시겠습니까?

Robert Zongo

댓글 삭제

이 댓글을 삭제하시겠습니까?